A survey of nearly 200 businesses has revealed they faced an average 63% fall in turnover in the first 10 days of the coronavirus lockdown.

And retailers are particularly concerned about the length of the shutdown and the impact on the future shape of the retail sector.

Members of the British Equestrian Trade Association – both retailers and suppliers – were consulted in the period up to April 2 and given the opportunity to share figures and fears.

“Covid-19’s unique and all-pervading impact is posing the greatest threat to the future of our trade that most of us will have ever experienced,” said BETA executive director Claire Williams.

“The survey allows us to identify key concerns and consider how we can best support our members through these incredibly challenging times, both during lockdown and the early stages of recovery.”

Last month, retailers experienced initial panic-buying of feed and bedding, followed by heightened demand for online services as the lockdown took effect.

The survey also showed consumer confusion about the types of business that could stay open to sell face-to-face.

Cash flow is a major concern, often because of invoices falling due for products that retailers have not yet had a chance to sell. Two-thirds of retailers have had no offers of help from suppliers.

Overall, stores saw a fall in turnover of between 20% and 100%. Those not trading at all are mainly saddle fitters, for whom social distancing rules make it challenging to do their job properly.

For suppliers, disruption of global supply chains – obtaining raw materials and delays to air and sea freight – were major issues, alongside controlling fixed overheads and managing the health and safety of staff.

Significant change

At the time of the survey, retailers had already made significant changes to the way they were running their stores. Fewer were combining physical shops and online than before covid-19 (31% down to 20%), with 28% (up from 2%) moving to online only. By the end of March, only 14% of retailers (down from 50%) were working solely from a shop.

As a result of coronavirus restrictions, 18% of retailers were forced to close all or part of their business. This group comprises mainly saddle fitters and shops without the ability to trade online.

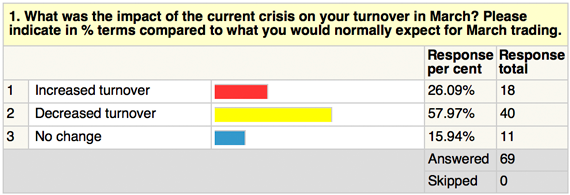

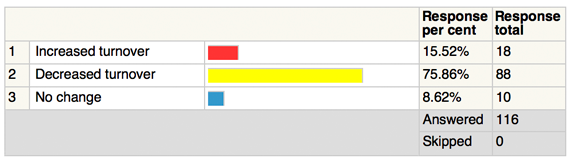

Turnover

Although 15% of retailers saw increased turnover linked to feed and bedding stockpiling, three-quarters experienced decreases in turnover ranging from 20% to 100%.

There was an average 63% drop in turnover across all types of equestrian retail outlet.

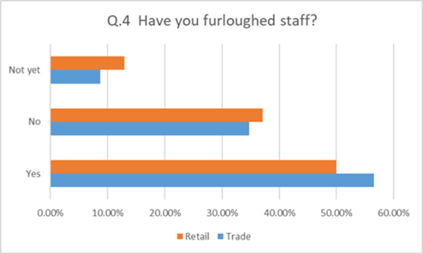

Furloughed staff

Half of retailers had furloughed staff by the end of March, with a further 13% intending to do so in April. This means that two-thirds are taking advantage of the Coronavirus Job Retention Scheme, with nearly half intending to apply for small business rates relief of £10,000 and nearly 20% applying for the retail grant of £25,000.

Half of retailers had furloughed staff by the end of March, with a further 13% intending to do so in April. This means that two-thirds are taking advantage of the Coronavirus Job Retention Scheme, with nearly half intending to apply for small business rates relief of £10,000 and nearly 20% applying for the retail grant of £25,000.

Retailer worries

Short- and long-term concerns centre on cash flow and ongoing fixed costs. Retailers are also concerned about invoices for seasonal stock falling due without the chance to sell it. The over-riding long-term concern was keeping businesses going until lockdown ends.

Assistance from suppliers

Some retailers reported little proactive contact from suppliers, while others mentioned gestures of payment extensions and drop-shipment offers. Nearly two-thirds reported no offers of assistance from suppliers.

Most felt that BETA’s response to the crisis was positive. Some retailers felt it was important to highlight to riders and horse-owners that they can shop for anything they wish, not just ‘essential’ items.

Impact on suppliers

The immediate impact on suppliers was less dramatic than on the retail sector. Companies making feed, bedding and other items for the upkeep of horses responded more robustly. Those dealing primarily in rider-related items such as clothing, safety equipment and tack saw a drop in two-thirds of turnover.

Most suppliers reduced office staff and hours or changed work roles. In many cases, company directors are now working in warehouses in charge of despatch!

Impact on supply chain

Three-quarters of suppliers reported serious impacts on supply chains, ranging from delays to raw materials and packaging to issues with air freight and sea freight.

Government support

Suppliers’ take-up of government assistance is broadly similar to that of retailers, although there was a lower proportion claiming rates-related relief. In addition, more suppliers are planning to apply for loans and other measures such as mortgage holidays.

Short- and long-term concerns

Suppliers’ views differ from retailers’ here, with focus as much on supply chains and pricing as revenue generation and cash flow. Concern was also raised about the length of the shutdown and the impact on the future shape of the retail sector.

When it came to measures taken for their retail customers, suppliers mentioned treating debtors sympathetically while simultaneously trying to ensure cash continues to come in.

Claire Williams said: “Many respondents show a real desire and will to survive, albeit based on being given an opportunity to do so. This will not come only from the end of lockdown, government assistance – financial and otherwise – and the equestrian bodies encouraging participants to return to our sport….

“Crucial to a recovery will be the importance of all parts of the equestrian trade working together to help one another. This means manufacturers, suppliers and retailers working through what are going to be challenging times. But, without this joint effort, we risk losing more businesses than we have ever lost before.

“All at BETA will do their utmost to ensure we play a key role in this recovery.”